Top 10 ways banks can turn subscriptions into real customer loyalty

by Ben Caveen | 20 Oct 2025

Cashback and points no longer inspire loyalty — they’re simply expected. Today, loyalty is built on everyday relevance and value customers actually use. In this month’s Bytesize webinar, I sat down with Andy Bovingdon to unpack how subscriptions are transforming banking loyalty. Here are ten takeaways — and why the future of loyalty lies in helping customers live better, not just bank better.

1. Loyalty isn’t broken — it’s just outdated

For years, loyalty meant points, cashback, or the occasional voucher tucked away in a banking app. But customer habits have moved on faster than those schemes. Digital-first consumers open, switch and close accounts more easily than ever, and with each new challenger bank promising a smoother experience, the emotional tie to a single provider weakens.

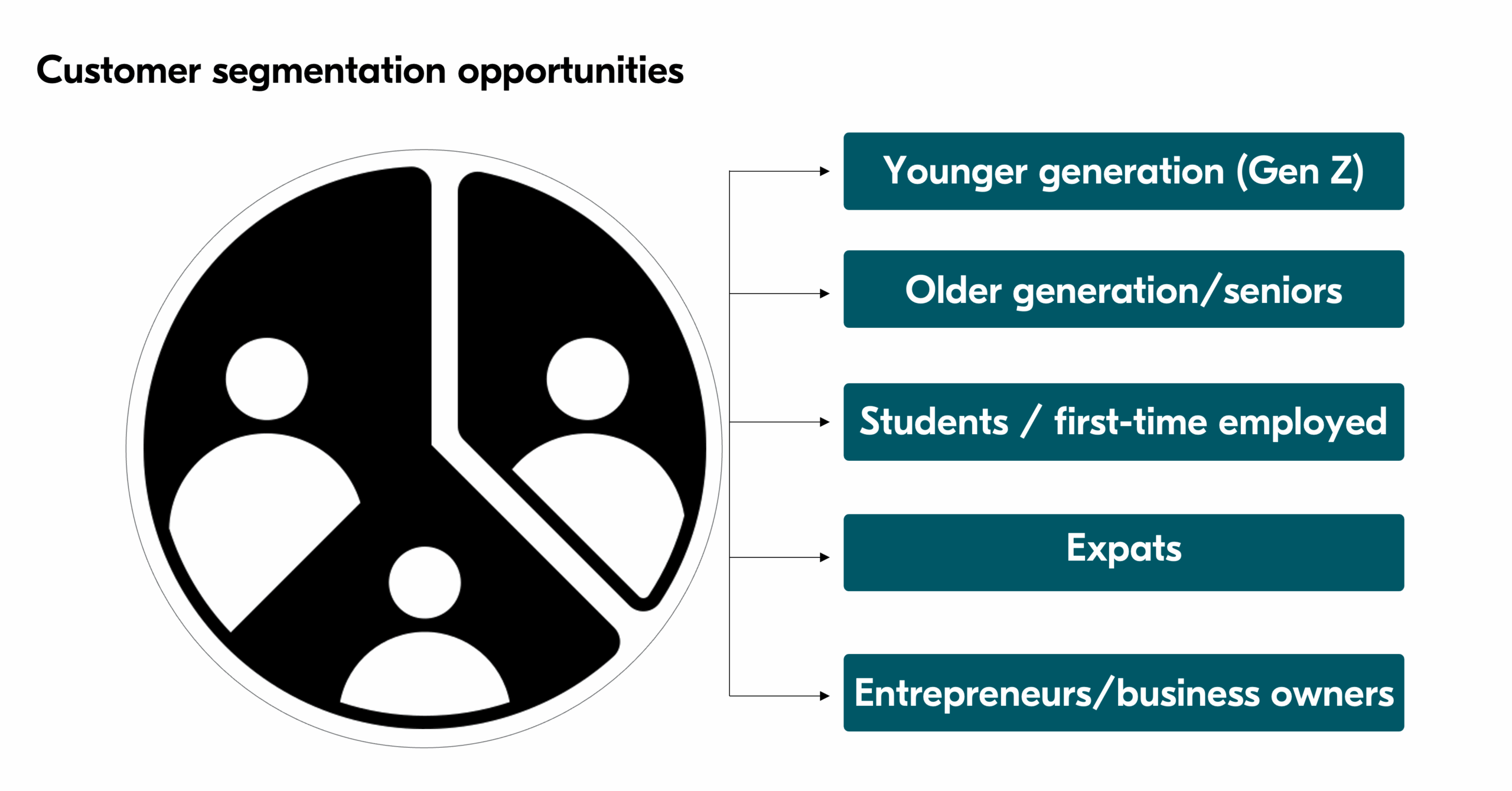

The result? A generation of customers who don’t stay loyal for long. Gen Z holds a current account for an average of just five years. That’s not disinterest — it’s a reflection of choice. When your competitors are a tap away, loyalty must be earned through continuous relevance, not one-off gestures.

Banks need to replace transactional rewards with relational value. That means understanding how customers live, not just how they spend. Subscriptions create those daily touchpoints. Instead of reminding customers every few months that you even exist, you become part of their everyday rhythm.

2. Subscriptions are the new loyalty currency

These services provide something traditional bank rewards can’t: habitual engagement. Customers open and use them almost daily. When a bank connects its brand to that same everyday value, it becomes part of something customers already love. That’s a very different relationship from one built on sporadic cashback on brands.

3. Stop sending customers away

That experience is inconsistent, clunky, and completely breaks the customer journey. Each offer looks and feels different, with varying terms and cancellation rules. For customers, that’s confusing. For banks, it’s a lost relationship and missed data on ongoing engagement.

4. Make bundles, not one-off offers

5. Use data to tailor value

A Gen Z customer might value streaming, gaming or AI tools. A high-flying professional might lean towards productivity, identity protection and travel benefits. Families could be drawn to music and multi-user streaming, while expats might appreciate language or international news subscriptions.

6. Make dormant accounts active again

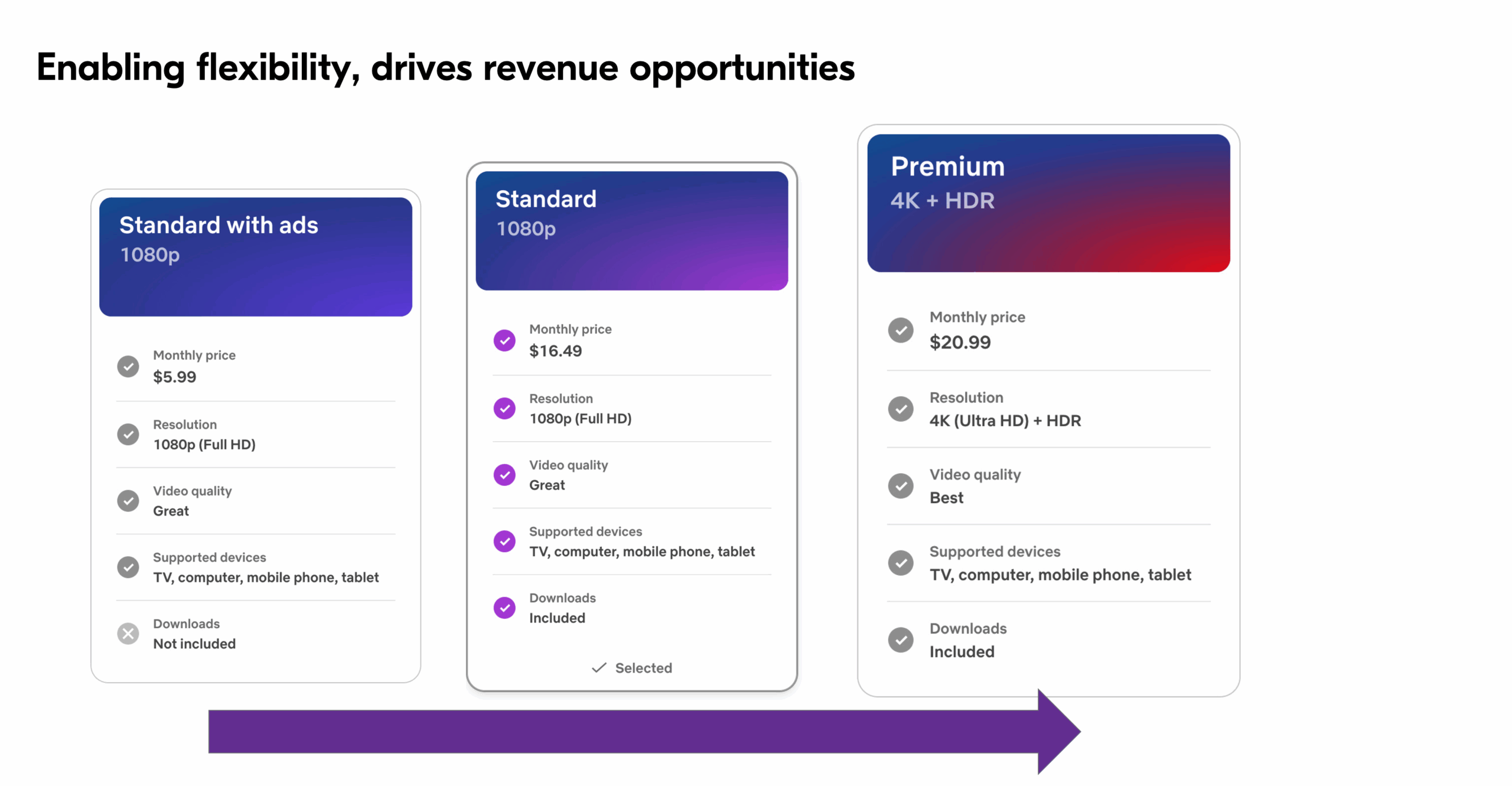

7. Think revenue, not just reward/cost

8. Standardize the messy bits

Banks can solve these pain points. By working content partners and controlling the experience, they can standardize everything: clear trial periods, transparent transitions from free to paid and straightforward cancellation. The Digital Vending Machine® from Bango (DVMTM) handles all of this complexity with each content provider integration, standardizing everything so banks don’t have to.

9. Learn from telcos

Banks can take that playbook further. With built-in payment infrastructure and higher customer trust, they’re in a stronger position to manage subscriptions at scale. A subscription hub within a banking app offers convenience and consolidates customers’ financial and digital lives.

10. Move fast, or risk being left behind

The concept of subscription bundling isn’t new. What separates the leaders is how quickly they can execute. Managing multiple content partnerships, integrations and billing systems takes time — and time is the enemy in a fast-moving market.

That’s why more banks are adopting Digital Vending Machine® from Bango (DVMTM). It standardizes partner management, simplifies billing and allows new bundles to launch in weeks rather than months or even years in some cases. It’s a plug-and-play route into the subscription economy.

Revolut’s advantage wasn’t just innovation; it was speed. Traditional retail banks can still catch up, but the window is closing fast. The banks that act now will define the loyalty model everyone else follows.

Final thoughts and next steps

Subscription bundling is becoming the new loyalty currency. It’s a way for banks to move from transactional interactions to meaningful, everyday engagement. The goal isn’t just to retain customers, it’s to earn a place in their daily lives.

Those who move early will win deeper relationships, stronger engagement, and fresh revenue streams. Those who wait will be competing with customer habits that have already formed.

Standing up dozens of content partnerships, integrations and operations is hard if you do it piecemeal. This is where a Digital Vending Machine® approach helps:

- Partner management: connect the right subscription brands quickly

- Offer creation: included soft and hard bundles, promos, discounted multi-party bundles

- Distribution: white-label CX journeys across app, web and campaigns

- Lifecycle & billing: free-to-paid, upgrades, add-ons and always in sync

- Continuous optimization: test, measure and iterate

Start small (e.g., YouTube Premium as a reward), then scale to multi-party bundles or a full marketplace from the same foundation.

Loyalty pays survey report

Consumers expect more than cashback or one-off rewards. Discover how subscription bundling helps banks, neobanks and wallet providers to drive loyalty, boost engagement, and unlock new revenue in today’s competitive market.

Watch Bytesize webinar

A 40-minute session unpacking how banks can rebuild meaningful engagement by connecting customers to the digital experiences they actually value.

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.